We are entering the new year with the global economy on the verge of recession, so it is only logical to wonder what the next year is going to look like in terms of investments. 2022 has shown that the market can’t grow forever and a correction can come at any moment. With the year bringing major inflation and turning the market red, many traders wonder what assets to trade in 2023. Here are some picks from the three sectors that are looking promising for next year.

Technology sector

Netflix

The streaming platform had a challenging year in 2022. Though Netflix is still traded at a much lower price than the year before, it is expected to boost its performance by shifting its business model. The company plans to introduce a new subscription plan that will support ads and be available at a lower price. A cheaper option has the potential to attract many new customers as well as marketers that wish to promote their products and services through the platform.

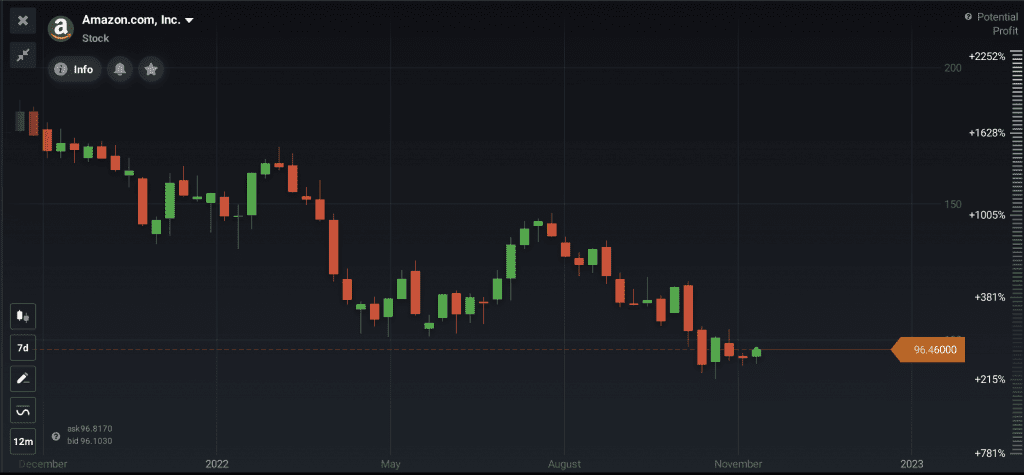

Amazon

J. P. Morgan’s top pick, Amazon has been focusing on investing in transportation and expanding its fulfillment capacity. 2023 could be the year we see the company’s efforts pay off and profits recover. Amazon’s strong fundamentals indicate that right now could be the time to enter a “buying” position at a discount.

Financial sector

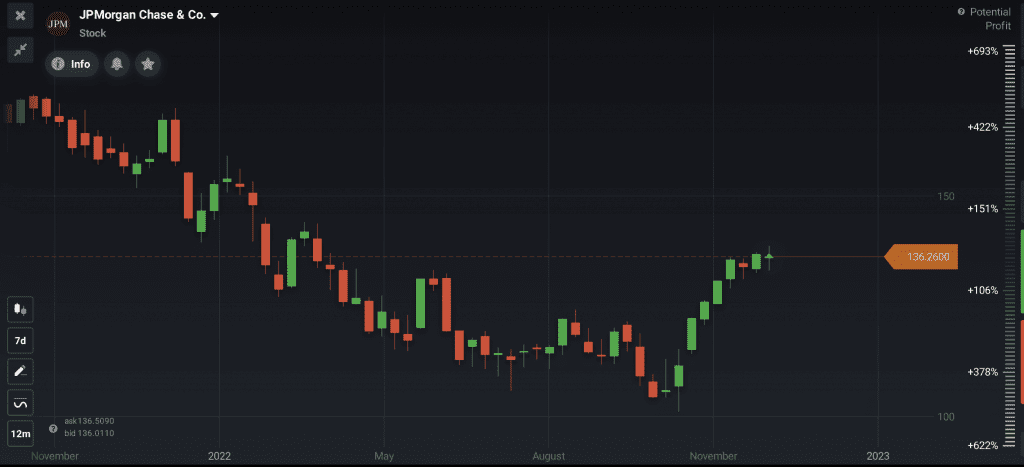

JP Morgan Chase & Co.

While many investor’s eyes are on the technology sector, other industries can be easily overlooked. Large banks remain on sale, though the prospects for recovery in 2023 can be quite promising. JP Morgan shares started regaining their value in October and seem to be heading towards recovery. However, it is not unlikely that the stock might present more selling opportunities, so bearish traders may want to closely monitor the volatility of the asset.

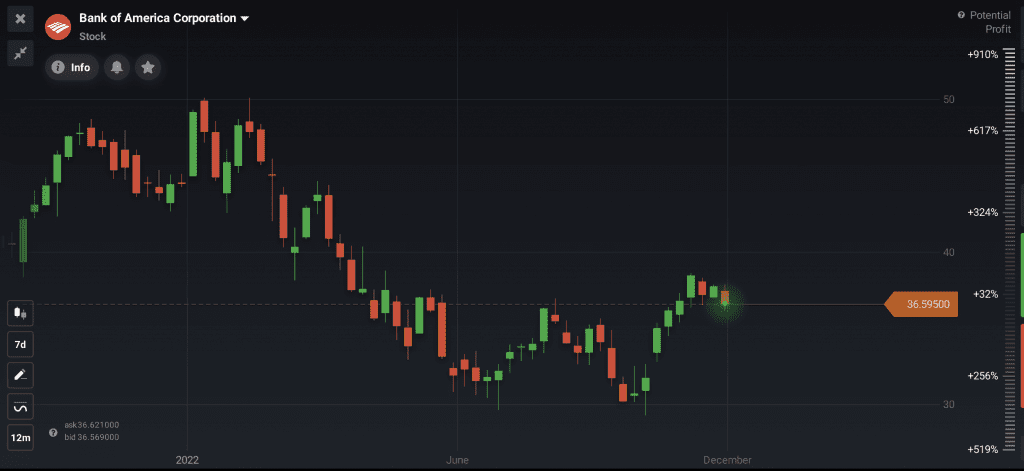

Bank of America

Bank of America is one of Berkshire Hathaway’s largest equity holdings, which says a lot about how it is evaluated by professional investors. Despite being down 18% year-to-date, the trader’s sentiment* for Bank of America remains bullish, and it could be one of the assets to trade in 2023.

Energy sector

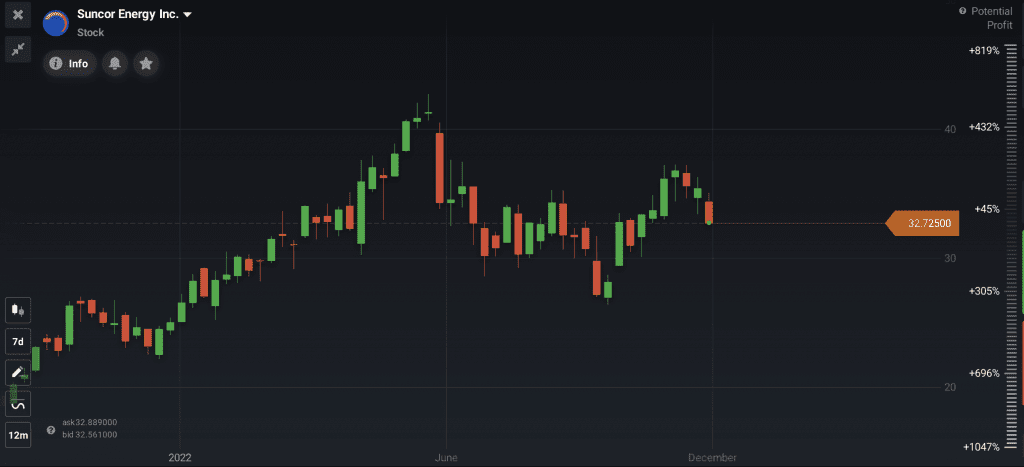

Suncor Energy Inc.

The Russia-Ukraine war has left Europe on a verge of an energy crisis and has caused a shortage of gas, driving the prices up. The Canadian natural gas and crude oil company is a candidate for increased profits in 2023, as global supply fears grow stronger. With a 99% bullish trader’s sentiment*, this company can be considered both for long-term and short-term trades.

Which assets are you picking for your 2023 trading plan? If you are looking for more ideas, check our list of the top winners and losers of 2022.

Please note that the assets are assessed based on their performance and fundamentals, however this evaluation does not guarantee the performance of the asset and is not an investment advice.

*Trader’s sentiment on the IQ Option platform