Trading platforms often have a variety of features for efficient trading and technical analysis. Yet, Grinch — a trading enthusiast with years of experience — tells us that not many traders use them to the full: they tend to stick to basic tools and ignore the rest. That’s a pity – some of the traderoom features can help you save time and get better results.

For instance, have you ever played with the standard indicator settings to get a more accurate reading? Or used a combination of several indicators for technical analysis? Both are great methods that may enhance your trading experience. If they do, you might want to repeat the success and apply the same approach for future trades. Here’s where our secret technical analysis tip comes in.

☝️

Let’s say that there is one indicator combination that you often use for asset analysis. And every time you have to spend time finding the indicators in the menu and adjusting the settings. By using templates, you can avoid all that and just apply the combo to the chart with one click. Sounds good, doesn’t it?

Here is how you can set it up.

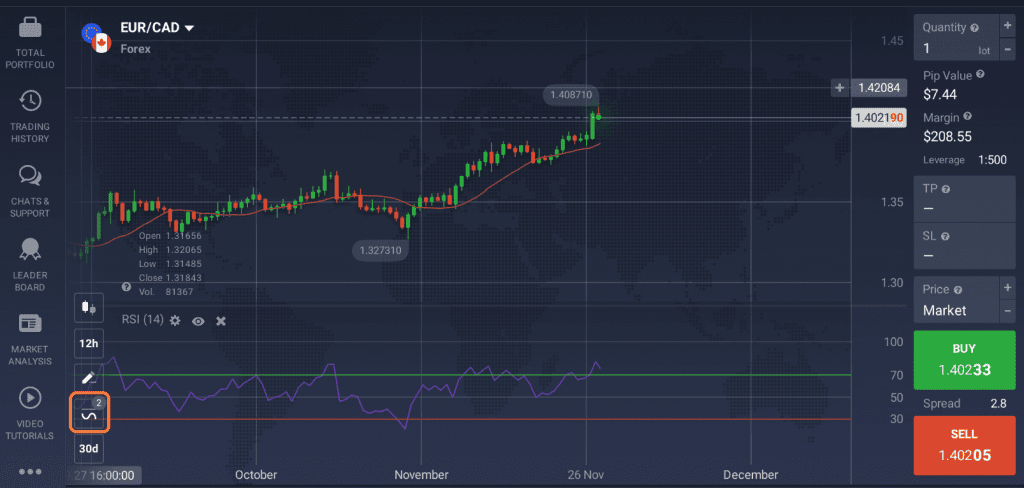

- Go to the indicator menu and choose the tools you want to use. Adjust the settings and apply them to the chart.

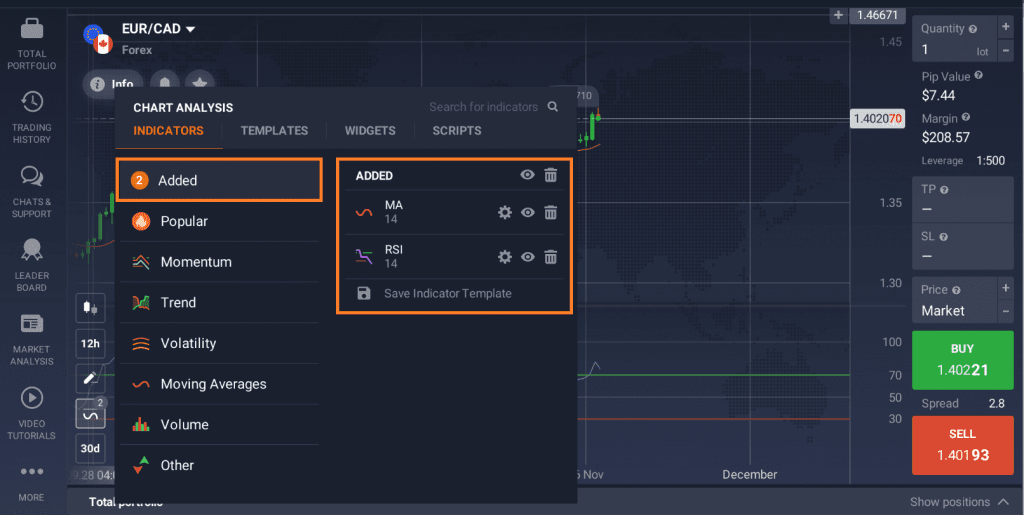

2. Go back to the indicator menu and find the applied tools in the Added section.

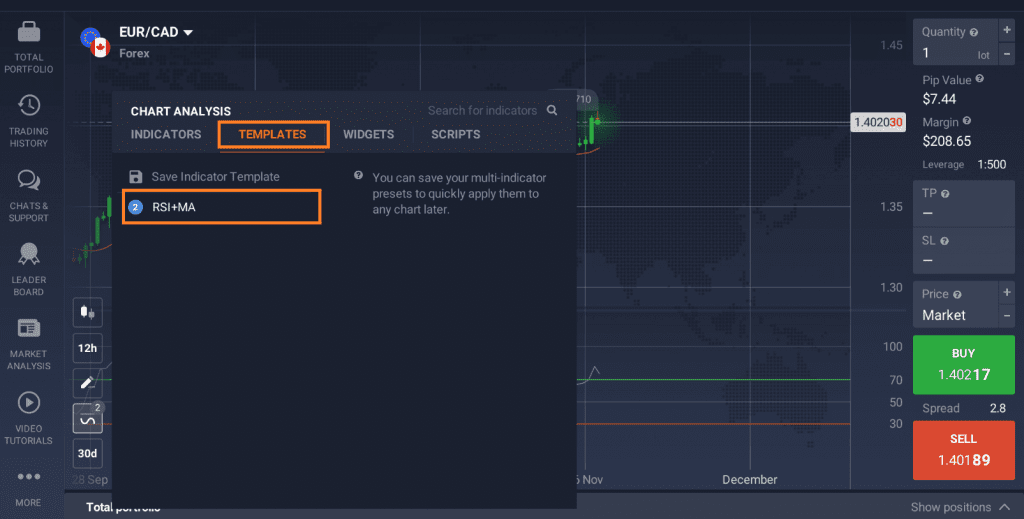

3. Click on the Save Indicator Template button and name your first template. Done! It’s saved in the Templates tab.

Now you will be able to apply this indicator combo to any asset: just click on the template to activate it. This feature is a great way to save time and preserve great trading strategies for future use.

How to Choose Technical Indicators for Trading?

If you haven’t used any indicators for asset analysis, you may want to start with the basics. For example, Moving Average is one of the most popular technical analysis tools that is both simple and effective.

Once you get more comfortable with this method, you can try out more advanced instruments, like ATR (Average True Range) or the Alligator Indicator. Or go for a great indicator combo, such as RSI + Stochastic Oscillator. Whatever you choose, remember that even the best instruments can’t give 100% accurate readings, so always use risk-management tools to protect your investments.