Recently, cryptocurrency has made a serious leap into the mainstream. Though no trend lasts forever, it seems that crypto is becoming more and more popular year on year. Here we’ll be dipping into learning how to trade crypto on the IQ Option platform.

What is Crypto?

Some of the biggest cryptocurrencies are fast becoming household names – Bitcoin, Etherium, Ripple, Litecoin and so on. Many traders have already gained some experience in trading these assets, or they may have purchased them to hold on to on a long-term basis. But what are cryptocurrencies and why do their prices fall and rise? Let’s take a closer look.

Cryptos are digital currencies — they don’t have a physical form like standard paper currency does. Perhaps the most important part about crypto is that it isn’t issued by one single central authority, which in theory makes them immune to manipulation or interference. Most cryptocurrencies are based on blockchain technology, where its security is governed by confirmations. As their popularity grows, they have quickly become an accepted payment method around the world.

A cryptocurrency glossary

As with any asset, crypto trading has its own set of integral rules and terms that traders have to follow in order to understand the market and its conditions. Let’s go through each of the most commonly used crypto terms:

Order – an order placed on the exchange to purchase or sell crypto

Fiat – regular money, issued and supported by a state (like for example USD, EUR, GBP etc)

Mining – processing and decrypting crypto transactions, to get new cryptocurrency

HODL – a misspelling of ‘hold’ that stuck around! It means purchasing cryptocurrency with the intention of keeping it for a long time and expecting the price to grow

Satoshi – 0,00000001 BTC – the smallest part of a BTC, it can be compared to 1 cent in USD

Bulls – traders who believe that the price will rise and prefer to buy at a low price and then sell at a higher value later

Bears – traders who believe the asset price will decrease and may benefit from the asset value going down

Step by step Crypto trading

Cryptocurrencies on IQ Option are presented as CFD-based trading. This means that when a trader opens a deal, they make predictions regarding the change in price of the asset in question. Traders can speculate on the price changes, but they don’t own the cryptocurrency itself.

Here is a step-by-step explanation of CFD crypto trading on the IQ Option platform:

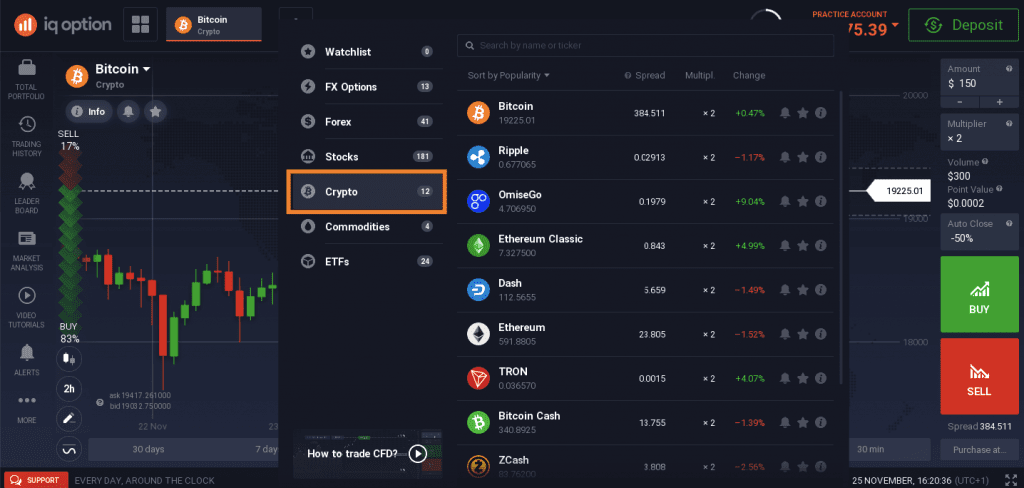

1. To begin trading cryptocurrencies, open the traderoom and click the ‘+’ sign at the top to open the asset list

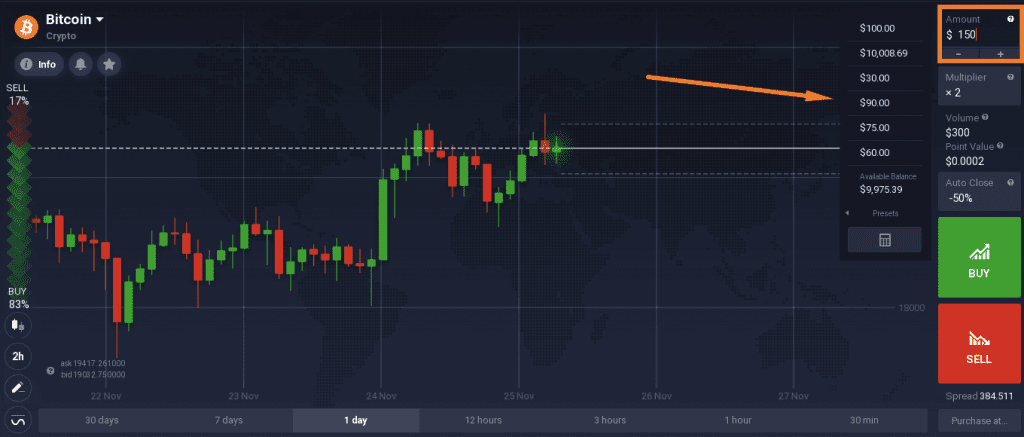

2. Find the cryptocurrency that you are interested in and then enter the amount that you wish to invest

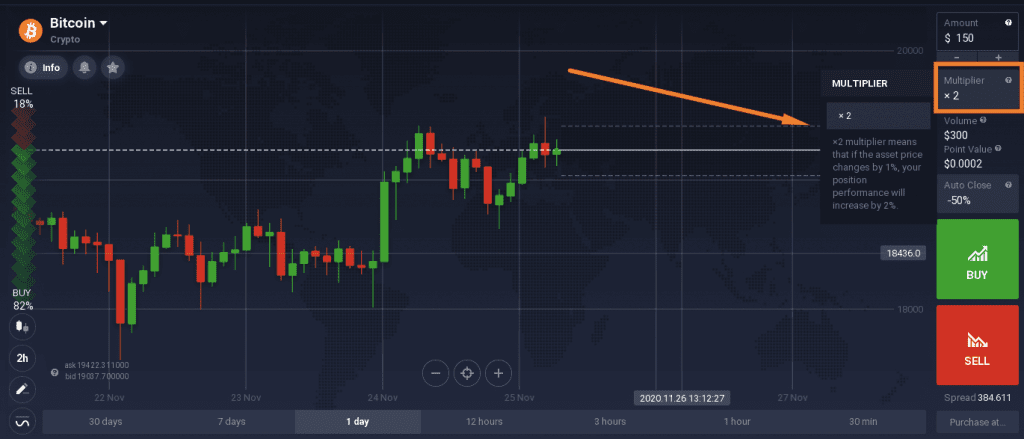

3. Note that cryptocurrencies are traded with a multiplier

A multiplier is the analogue version of standard leverage. It provides you with the possibility of a higher outcome, but it also increases the risk.

Based on your investment and the chosen multiplier, you will then see the total trading volume. This is the amount which the outcome of the deal will depend on.

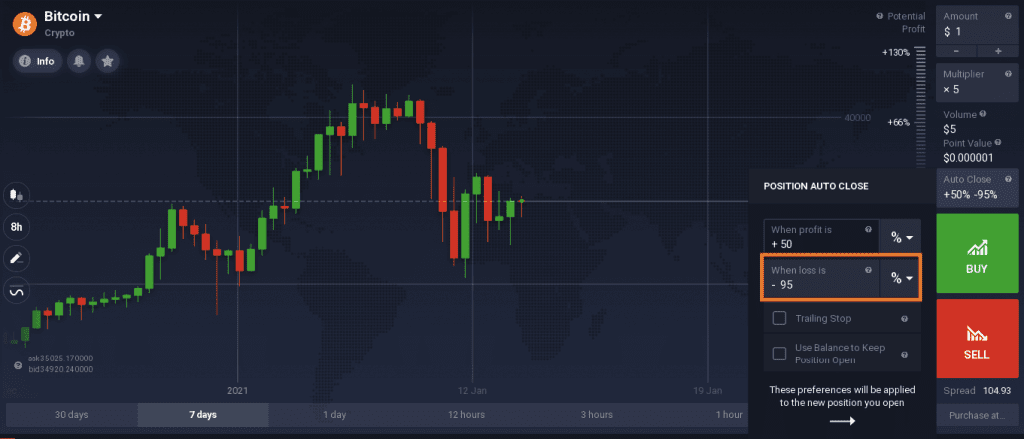

4. The last step before opening a deal is to set autoclose levels, in order to adjust the deal to your preferred risk management approach

Note that a stop loss level of -95% is automatically set to all deals. Traders are able to reduce this level (e.g. set it at -60%).

If a trader wishes to increase the level, they may utilize their balance funds in order to keep the deal open longer, even after the level of -95% is reached. A trailing stop loss may also be used in order to secure certain outcomes in case of a positive price change.

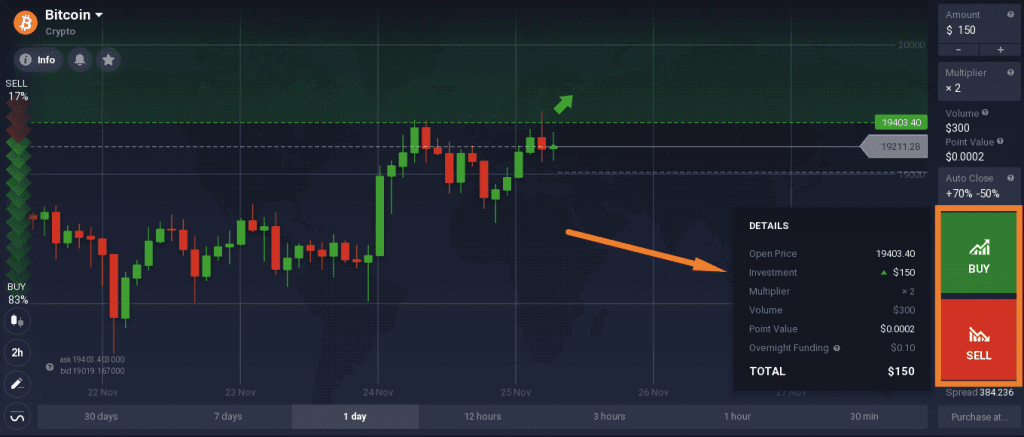

5. To open a deal, a trader needs to click either the Buy or Sell button, depending on the expected price change (i.e. up or down respectively)

When a trader clicks one of the buttons, the details of the deal they are about to open become available. These details include: the open price, investment, multiplier, volume, point value as well as the overnight charges. By doing it this way, traders can double-check all of the information before confirming the deal.

Market analysis

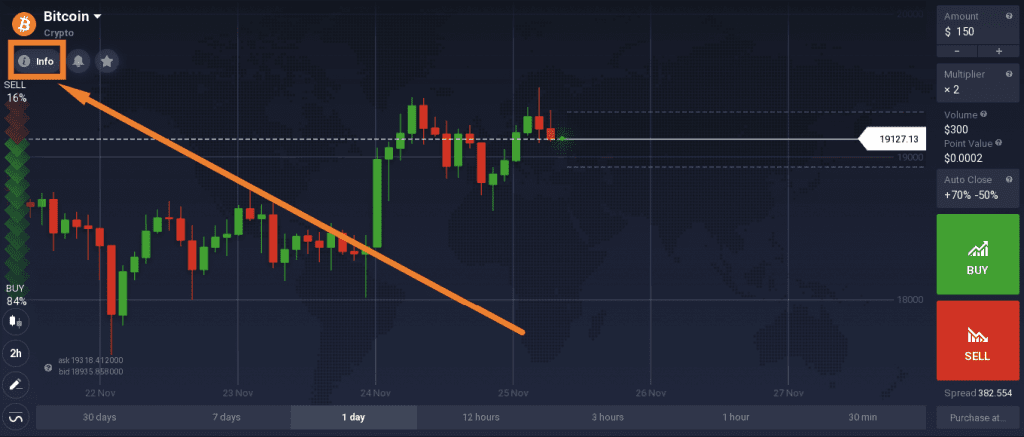

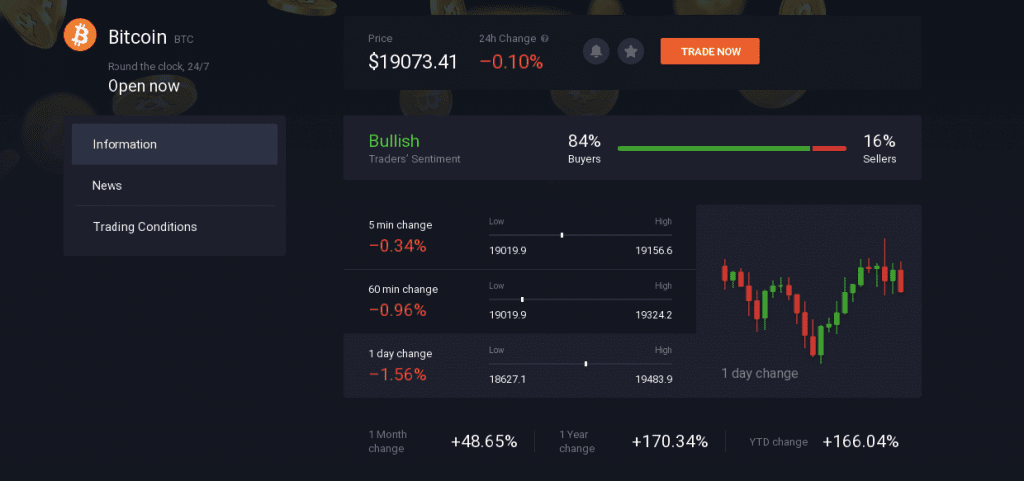

In order to make a decision on buying or selling cryptocurrency, traders may want to use the technical indicators provided. Alternatively, they can also check out the ‘info’ section available for every asset in the traderoom.

This section displays the information about the current trend tendency (bearish or bullish), the summary of indicators’ signals, as well as a lot of other useful information that could assist a trader.

You can also find the latest and most relevant updates about the asset in the ‘News’ section. Though this section cannot replace a trader’s own analysis, it may help traders in forming a more considered and full picture of how the asset and industry is doing.