Trading may sometimes feel like a roller coaster, especially for beginner traders. Getting the most out of this ride requires certain skills and knowledge. Still, you do not need to know everything about trading right from the get-go: covering the basics might suffice. Here are several steps on how to start trading now.

Set Your Trading Goals

Before you start trading, it might be helpful to consider your long-term financial goals. Would you like to explore the world of trading as a hobby? Or are you just looking for a way to make extra money? Maybe you are considering becoming a day trader and making this your full-time job? Each alternative requires different degrees of knowledge and amount of time to master the skills. Deciding on your goals from the beginning may help you come up with an effective trading strategy.

You may also think about making a trading plan. Think of it as your trading roadmap: a set of rules that helps organize this process. It can include your short-term financial goals, preferred trading instruments, trading schedule, etc. You can alter it over time or make additions to improve it. However, you should stick to your trading plan most of the time and follow its rules while making trades. This way, you may be able to avoid spur-of-the-moment decisions that might negatively affect your long-term trading strategy.

To come up with the rules for your trading plan, you can ask yourself a series of questions. For example, how often do you check your portfolio? How much money are you willing to put in? When do you generally enter / exit a trade? What steps will you take to analyze a new asset? These questions may be tough to answer at first, but having a set of rules is supposed to help traders avoid reckless decisions and unnecessary losses.

Choose Your Broker

How to choose a broker for trading? You may choose between different brokers depending on your goals and preferred trading tools. Some specialize on certain instruments, like Forex or Binary options. Others offer a variety of trading tools to try out. Trading terms, such as fees and deposit methods, might vary as well, so make sure to choose the broker that fits your needs. If you are still in doubt, take a look at this comparison table of 4 brokerage firms that might interest potential traders.

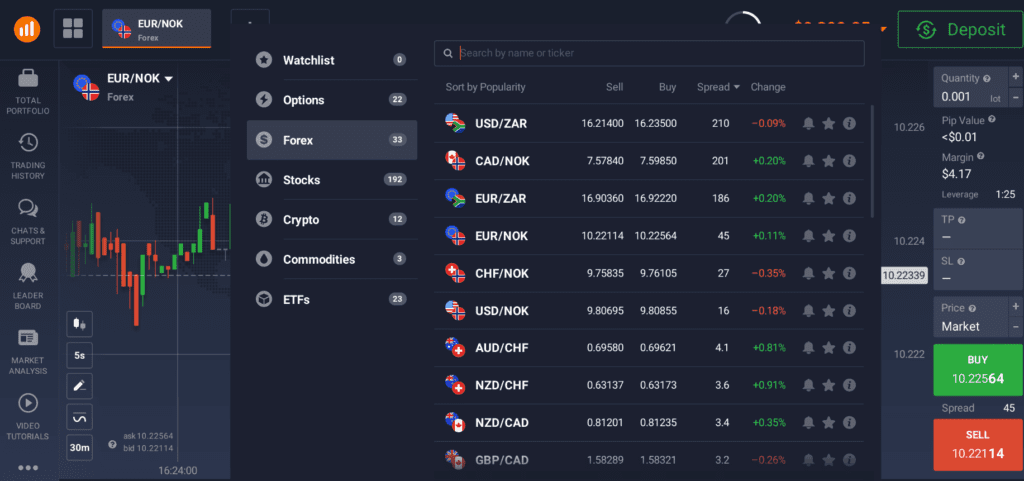

For example, IQ Option offers Binary and Digital options, as well as CFD-type trading for Stocks, Forex, ETFs and Commodities. The minimum deposit on the platform is $10, and there are different deposit methods depending on your location. Here is a step-by-step guide to get started with IQ Option: How to Register an IQ Option Account.

Learn Trading Basics

To make successful trades, you should understand some basic trading concepts. Here are a few that can get you started.

Forex

It stands for foreign exchange markets – a global marketplace for currency exchanges. Currencies here trade against each other as exchange pairs. For instance, a USD/EUR currency pair indicates how many U.S. dollars (the quote currency) are needed to purchase one euro (the base currency).

Day Trading

This activity involves trading assets within a single day. If you open positions and then close them in one day, you may be considered a day trader. It doesn’t mean that holding positions overnight is prohibited, but the majority of trades are usually made within one day. This method differs from regular trading or investing: it focuses on short-term price fluctuations and various factors that can cause them. Day traders may prefer more volatile assets that wouldn’t attract long-term investors, as they might create more interesting trading opportunities.

Bull Market

It is a condition of financial markets characterized by price rises or strong expectations of such rises in the near future. A bullish trend can be temporary, so traders should pay close attention to market changes to catch the right moment and make their move.

Bear Market

This state of the market is the opposite: it occurs when prices drop or are expected to be falling soon. Usually, if prices fall 20% or more from recent figures, it may be called a bear market or a bearish trend. Traders should take these market conditions into account when considering a trade, as they may affect asset value and present trading opportunities.

Technical Analysis

It is a method of analyzing asset value and identifying trading opportunities. Traders look at recent price fluctuations and apply technical indicators to find patterns and try to predict future market trends and price changes. This approach can be used separately or together with fundamental analysis. The latter concentrates on financial data that reflects companies’ performance results and market value.

There is a lot of information that beginner traders may find useful. It is available in different formats: you can choose to read articles, watch videos or listen to podcasts. Just make sure to set enough time for learning: it may help you avoid common mistakes beginner traders make.

Start Trading

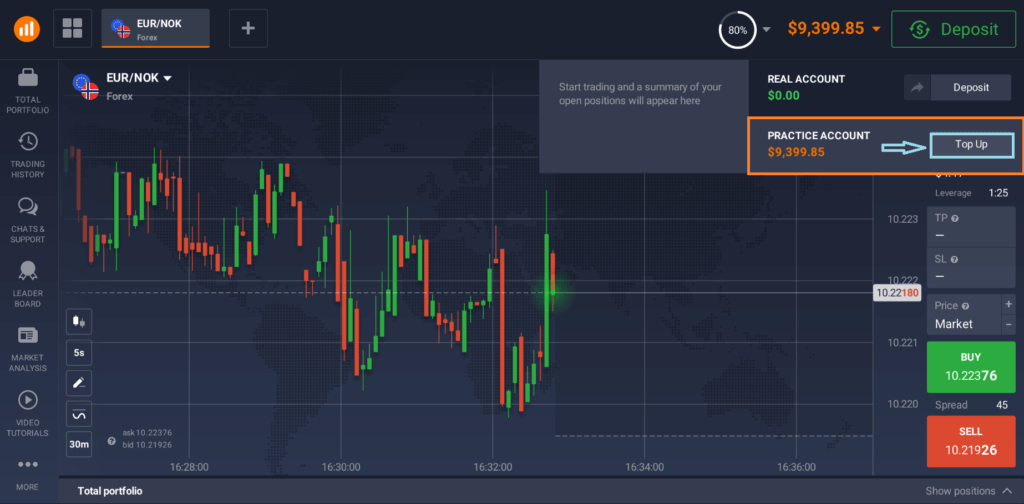

Do not rush into trading big right away – this may lead to losses and disappointment. Instead, begin by trying different approaches and trading instruments. You can trade for free using a practice account that allows you to get some trading experience without losing money. For example, IQ Option offers a demo account to all traders: it is a great chance to practice trading, understand the platform and its instruments and find trading methods that work for you. If you run out of money on your practice account, it can be topped up as many times as you need.

To make sure you are getting the most out of your practice account, take a look at this material: Ways to Utilize Practice Balance to Cut Losses in Real Trading.

You may also try participating in tournaments organized by IQ Option: they offer an opportunity to practice trading different instruments in a fun way and maybe even win some money. A number of tournaments are free, others have a small entry fee. You can learn more about the IQ Option tournaments in this article: IQ Option Tournaments — Trade, Compete & Earn.

Keep Going and Trade Better

To become a successful trader, you should try to stay focused. You might feel frustrated, if something doesn’t work out right away, but do not give up! Trading is a skill, so it can be mastered. All you need is time, continued efforts and some patience to get through the initial challenges.

There are many trading methods out there, so it might take time to choose the right ones for you. You may start with learning about the most popular approaches by reading articles on this blog. Here you will find detailed guides on using various trading methods, such as 5 Most Common Trading Strategies You Need to Know.

To accelerate the learning curve, keep exploring new trading instruments and methods. If you already learned how to trade binary options, check out some tips on how to trade stocks. Figured out how to use the economic calendar for trading? Move on to a more thorough fundamental analysis of assets. Picked up on a few basic indicators for technical analysis? Try out using a combination of several tools for a more precise result.

Bottom Line

Trading can be a powerful tool for reaching your financial goals, if used sensibly. You do not need much to start trading, however, getting positive results requires some learning and practice. Some beginner traders may feel overwhelmed at first, but do not be discouraged: just follow the steps from this guide on how to start trading and stay focused on your trading goals.