Everyone makes mistakes, and traders are no exception. Moreover, what many great traders have in common is their ability to learn from their mistakes. And plan their moves to prevent such errors in the future. But how can new traders without much experience do the same? We have prepared an overview of common beginner trading mistakes. Keep reading to learn how to spot potential mistakes to enhance your trading results.

Acting Without a Plan

This may be one of the most important beginner trading mistakes. Many traders ignore this step and suffer unnecessary losses as a result. However, a well-defined trading plan can significantly increase your chances of success.

A trading plan is basically a set of trading rules that you follow in almost 100% of deals. It may include the following information:

- When you trade (days of the week, time of the day, how many hours per day/week, etc.);

- When you enter or exit a trade. For instance, at which point do you close a losing deal?

- How much money you plan to invest and how much you can trade at once;

- How you choose assets for trading: do you use technical or fundamental analysis? Or maybe you prefer news trading?

These are just a few points you may consider adding to your trading plan. You can modify it to fit your needs and trading goals. But it is important to follow these rules most of the time to avoid spontaneous decisions. Doing so may add more structure to your trading and help achieve your financial goals.

To stay on top of your trading routine, you may use a trading journal. It helps to stay organized, keep track of results and analyze psychological patterns in trading. Sometimes people make the same mistake many times without even realizing it. Checking your notes in the trading journal might help catch such patterns. Once you find them, you could add a new rule to the trading plan to avoid similar errors in the future.

Following Others

Sometimes it’s hard to resist following the herd. There is a lot of information out there, so anyone can learn about trading from different sources. As a result, some people may consider themselves experts even without proper education or experience. They may seem very convincing and knowledgeable, but it doesn’t mean you should blindly follow their advice.

Moreover, as we know, even true experts make mistakes. So it is in your interest to carefully consider any trading tips you may hear or read.

To be on the safe side, always check the information sources. Over time you will learn which sources provide more accurate data. Additional analysis to support your findings could also come in useful. This way, you may be able to make trading decisions based on reliable data and avoid common mistakes new traders make.

Going All In

Going all in is yet another frequent trading mistake. For instance, some beginner traders may expect high returns and invest more money than originally planned. Or stick to a losing trade for a long time and even put in more funds, hoping for a swift recovery. The outcome is unpredictable: these risks may bring positive results or cause a large loss (especially when trading with a margin).

☝️

In general, this rule might help protect your capital in the changing market conditions. Think about it: if you only risk 1% of your trading balance, you would have to lose 100 trades in a row to lose it all. Even if you are a new trader, the odds of this happening are considerably low. However, if this rule doesn’t work for you, there are other methods to try out. Just make sure to stay disciplined and follow the rules you have chosen to get the results you want.

Ignoring Take-Profit and Stop-Loss

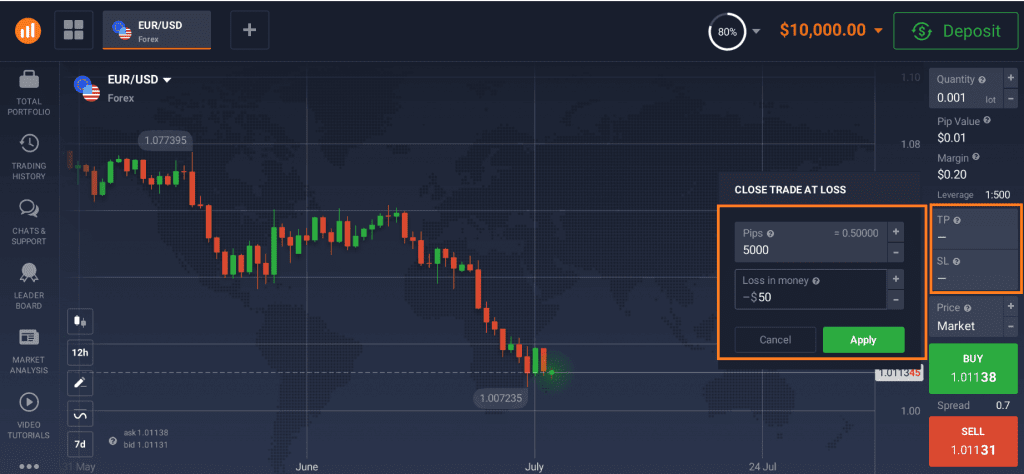

Take-Profit (TP) and Stop-Loss (SL) orders automatically close deals when a certain price level is reached (either in profit or at a loss). These are simple tools that may help you avoid common beginner trading mistakes. And protect your capital in turbulent market conditions, when prices suddenly go up or down.

Traders can generally set these orders in the traderoom. As an example, take a look at how Stop-Loss and Take-Profit can be applied in the IQ Option traderoom.

You may consider setting these orders for some or all of your open positions. Don’t forget to mention them in your trading journal too. If market trends change, you might want to modify your Stop-Loss and Take-Profit settings to get the best trading results.

The Bottom Line

It may be hard to avoid common beginner trading mistakes. However, they could be useful if you manage to learn from them. To achieve that, you may consider creating a trading plan. Be careful when following trading tips: do your own analysis to check any information. Sticking to your trading strategy and applying risk-management tools might also help you achieve your financial goals.